Learning To Cook A Budget Up From Scratch

For those of you who like to cook, grill, or bake, you already know it requires knowledge and precision to create good food. Any food connoisseur would probably agree – you cannot simply throw random food items together and make a masterpiece. You have to know how each item works and how they interact with each other. It requires time and effort to understand each food separately. We see great chefs, like Gordon Ramsey and Emeril Lagasse, who’ve studied food for many years. They took the time to learn the skills needed to prepare phenomenal dishes. The same can be associated with you and your budget. It can be easy to manage your money, but you need to start somewhere. Just like making a great meal, let’s make your budget from scratch.

Figuring out your shopping list

The first task you will need to do is make a “shopping list”. You need to list the following items out:

- All your bills by name with an approximate dollar amount (exact if you have it)

- All of your necessities by name and amount; this includes gas, groceries, etc.

- Contingency items, items you won’t buy every month (i.e. $20/Month for automotive)

- Healthcare items (i.e. Medical and Dental Visits, Prescriptions, etc.)

- Money to cheat with (i.e. restaurants, movies, treats, etc.) – THIS IS A MUST

- Charitable donations

- Set amount for savings

- Set amount extra for debt payoff

There are always those items you just can’t find

Some of the lists will be a little harder to complete, such as those for gas, groceries, and cheat money. You may not have these numbers readily available, or you don’t want to risk estimating these numbers incorrectly. This is perfectly fine, and better for your budget. In order for you to complete these lists, you are going to have to take time and be brutally honest with yourself. You need to take 1-2 weeks and write down EVERYTHING you spend, including bills. I would use a notepad and pen. If you are so inclined to use the computer or some tablet, this would be fine too. Do whatever works best for you, that you can start quickly. Don’t spend too much time figuring out how to track it. Just do it. After two weeks, you should have quite a few pages of purchases. Now, you will need to complete the arduous task of grouping these items.

Example:

- Gas = $25.00

- Meat = $10.00

- Toothpaste = $3.00

- Salad = $1.50

- 12 OZ Bottle of Soda = $2.00

- Movie Rental = $1.90

- Rent/Mortgage = $650.00

Groups:

- Grocery = $18.40

- Meat, Toothpaste, Salad, Soda

- Gas = $25.00

- Cheat Money = $1.90

- Rent/Mortgage = $650.00

Creating your recipes from your ingredients

Once you have grouped them together you will be able to see where most of your money is going every month. For bills and other expenses that occur monthly, simply label them as such. (IE: Rent, $950.) For everything else, you should multiply by two. This will provide a rough four-week estimate of expenses. Now add together the four-week expenses portion and those expenses which only occur once a month. Some of us will find this to be a very eye-opening realization. There are probably many items you are already thinking about cutting or thinking about cutting out of your purchases. Although this is a very wise move, it may not be necessary to jump to these extremes just yet. See the process to the end, and then re-evaluate everything.

The hardest task is over. The next part involves pulling together all of your income figures. What is your Net income (the number on your paycheck)? If you have multiple sources of income, document the amount and the frequency of each. Next, calculate how many times you will receive each income amount in a four week period. The total will be your approximated monthly income. This number may vary from month to month depending on your income frequency. At this point, you should have all of your income, and all of your approximate monthly expenses.

Understanding the ingredients

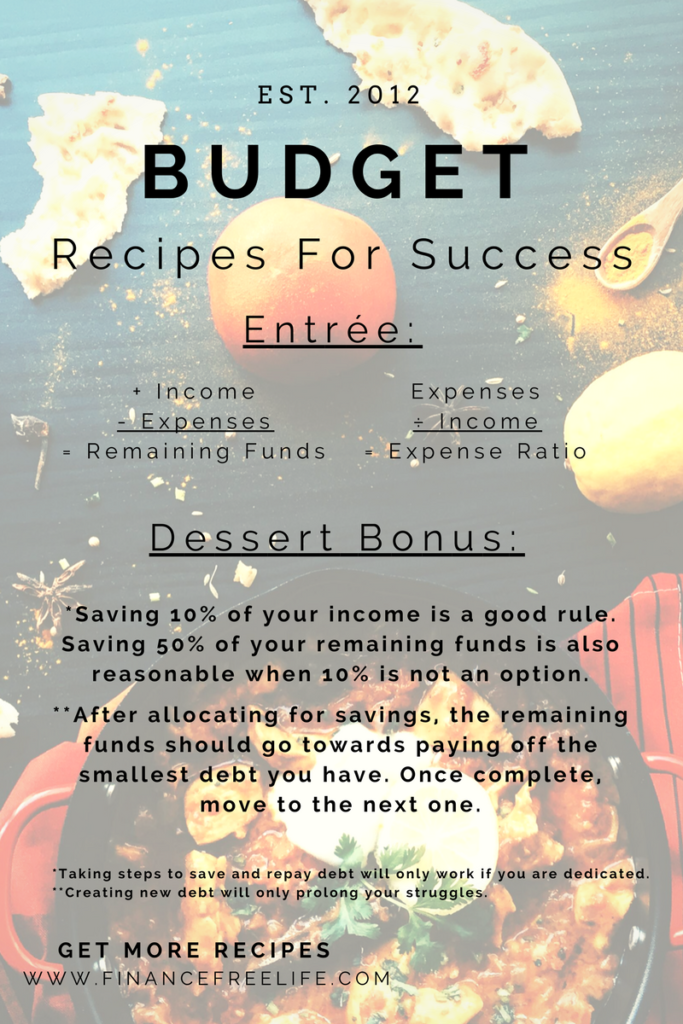

Let’s figure out your expense ratio. This is NOT the same as your Debt to Income Ratio (DTI). Take your expense amount and divide it by your income amount. For clarity, also subtract your expenses from your income.

Example:

- Income = $2000.00/Month

- Expenses = $1250.00/Month

$1250.00/$2000.00 = 62.5%

* This is not necessarily a bad number, as long as all items have been accounted for*

$2000.00 – $1250.00 = $750.00

*This is a good remaining balance as long as there is nothing else outstanding*

Creating the steps for a perfect meal

We have reached the point in the process of evaluation. Everyone’s numbers will be different. If you have a negative number or are over 100%, you have just found your underlying money issue – you are spending more money than you make. Although you may have already known you have this issue, you may not have known to what extent. Now you can correct the issue.

Review the items in your lists. I would suggest using different colored highlighters. Highlight those purchases which you NEED as one color, those you don’t as another color, and those you aren’t sure about as a different color as well. You should be able to go through again and make a list for each set of colored items. (Don’t go BUY colored highlighters for this task. Create a separate list with columns if you don’t have the ability to highlight).

Need to spruce it up? Try going for some low hanging fruit

Focus on those items you don’t need. How do you stop getting them, or discontinue the services? Add up all of these items which you will go without next month. How much are you able to save now?

Move to the uncertainty category. There might be some items you can label under your “cheat” category for your budget. For everything else, can you stop buying them or discontinue the service? Add those figures up for the items you won’t incorporate in future budgets. How much money are you going to save in the coming months?

The process will be very time-consuming, but it should also be very informative. You should have the values you will be saved from each of the previous categories we talked about. Subtract them from your current monthly expense and recalculate the percentage and remaining values from your income as performed above. Does this percentage look better? What about this extra cash you will now have every month? Pretty nice, huh?

Cooking and baking takes time, continue to learn as you go!

Your budget is not going to be perfect overnight. However, you have just made a huge step towards getting your finances under control. There are plenty of different forms of budget templates, and budgeting software available to you online. Any of them should work for a basic level. However, if you are interested in going more in-depth with your budget, be sure to subscribe to our email list. You will receive updates, free products, and access to our monthly newsletter.

I hope you all have learned a lot today, and you are ready to get your life back on track with a strong budget.

Leave a comment below, and be sure to share!