Are You More Of A Spender Or A Saver? – Part 1

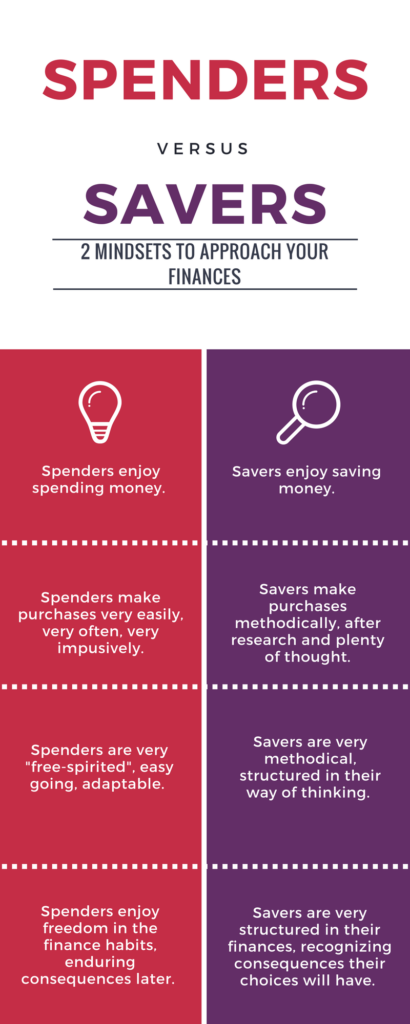

When it comes to money, there are 2 contrasting mindsets that people tend to have: spenders and savers. A spender is a person who, basically, likes to spend money. They are good at spending money, finding deals, and they don’t struggle with the emotional repercussions of big purchases. They are very free-spirited, and they spend money easily. Savers, on the other hand, are very structured when it comes to spending money. They struggle with spending, especially large purchases, and will agonize for weeks or months over a purchase, researching in depth before they are comfortable making the purchase.

With time and experience, you can find a balance between the two extremes. However, you will always be either a spender or a saver in your life. Neither mindset is bad in their own regard, provided they have a balance. Typically this comes in the form of a spouse or budget. Both of these are not easily maintained unless there is the dedication to ensuring it will work. Each situation is unique, but if you understand your mindset towards money, you will be able to achieve the balance you are looking for.

The Life of a Spender

As a natural spender, it is very easy for me to spend money. On a daily basis, I am always thinking of the things that I want and need to buy. Sometimes it is as simple as groceries and household items. Other times, it is a much larger purchase, like a new pair of shoes, office supplies, a new outfit, or even beauty products. At its core, there is nothing wrong with having the mindset of a spender, provided you can keep it in check. You need to be able to understand that all of these desires to purchase are not needs, but rather wants, and are not necessary to purchase on a whim.

Acting on impulse and purchasing everything that comes to mind is when the Spender’s Mindset becomes a major problem. Before you know it, you have lots of “stuff” that you thought you wanted, nowhere to store it, and no money left in your bank account to pay your bills. Your impulse spending has left you broke, again.

This is where a budget comes into play. Your budget can break the cycle.

From the mindset of a spender, a budget may initially be a trigger word – a word that invokes fear, anger, anxiety, even dread. You will have to defend your superfluous spending, and make cuts to where you are spending, stealing all of the happiness you feel from spending money.

Every time my husband brought up “the budget”, it put me down. I felt like it was a set of iron shackles, chaining me to a confined space. A budget meant that I couldn’t spend money on anything, and I had to live within the strict confines of that budget. I did NOT want that.

However, when I finally sat down with him to discuss the budget, I found something completely different. I found freedom. The budget was not a set of shackles around me, preventing me from spending any money. Instead, it gave me the freedom to spend money within the budget. In creating the budget, and maintaining it weekly, I found areas of the budget that allow me to spend money freely. Because I am a spender, my husband even gave us each a personal fund within the budget. That is money that I can spend on whatever I want, whenever I want. There’s a clothing allotment in our budget. When we want new clothes, the money is there! I don’t have to stress about buying a new dress for a party because the money in the budget allows me to spend that.

If the Spender’s Mindset describes you, I would encourage you to create a budget, no matter how badly you want to avoid it. You need a budget, more than you know. For a spender, a budget is like the rules and structure set by a parent for a young child. It is a boundary, but it provides you with the structure and freedom to live within that boundary. If you struggle with these financial decisions, look at these 3 questions. These will help you start making wise choices with your spender’s mindset.

If you don’t have a working budget yet, check out these posts on budgeting: Create a budget, Revamp Your Budget, and Starting a Budget from Scratch. These will help you get started on your path towards financial freedom. And, if you haven’t already, be sure to join our email newsletter. You will receive a free budgeting tool when you enroll