Create a Budget That WORKS!

The very first step to taking control of your money is creating a budget. For some of you, creating a budget may seem like a very daunting task.

“Where do I start?”

“How do I make a budget?”

“What is a budget?”

At its core, it is really as simple this: your income, minus your expenses. That’s it. Now, when I say expenses, I mean ALL of your expenses. If you can’t live without your daily coffee run, include that in your budget. Car repairs? Those come up, often unexpected. Plan for it. Plan for everything that you spend money on, want to spend money on, etc. If you don’t plan for it, and you don’t tell your money what to do, it will walk away from you. You’ll be back to being broke and wondering where all your money went.

Before we create your budget, I want to encourage you that your first budget is just that – a FIRST budget. It won’t be perfect, no matter how hard you try. You’ll forget something, make mistakes, overspend, under budget, and so on… Our first budget was NOT perfect. We made mistakes, we had missing elements, and we even had a DEFICIT in our budget the first time we did it. Yes, you read that right, a deficit. We were spending more money than we made, and confused about why we didn’t have any money left at the end of the month. After many years, challenges, budget meetings, and tweaking, we have a working budget. We still make mistakes, and we still have to manage our budget on a regular basis, but it is much easier than when we started 10 years ago.

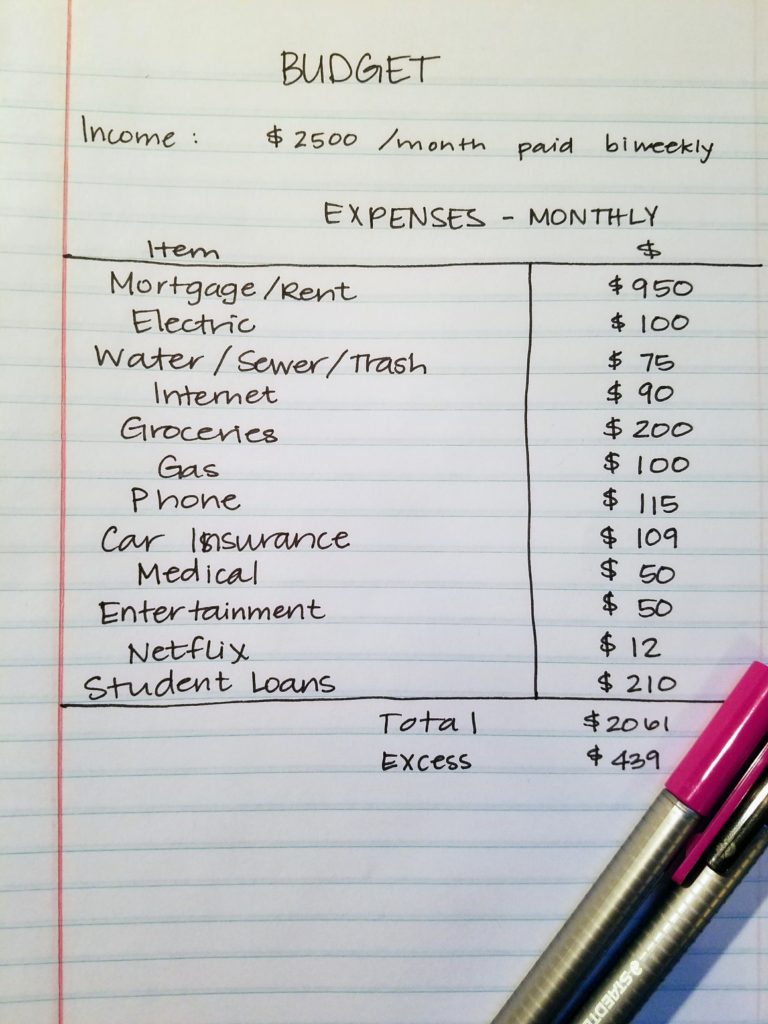

So, let’s get to a budget, and how to make your first budget. The first step in making your budget: list your income. If you are salary, this part is easy. Your paycheck stays the same week to week. So, your income would be your monthly income. You want to use your net take-home pay, not your gross. You can’t use the money that is being paid towards your taxes to buy groceries.

If you are hourly, create your budget on your average pay. If you typically work 40 hours a week, calculate your income for that. DO NOT include overtime pay in your budget. Even if you constantly work overtime at your job. It is not guaranteed money every month, you don’t want to depend on it for your income.

If you have an irregular income, this is more challenging. Check out this post by Dave Ramsey to start a budget on an irregular income.

Once you have your income listed, start to list your expenses. On your rough draft, you can list them in any order. Typically, we list them based on priority. House payment, groceries, gas, utilities, then down to extras like eating out, Starbucks, etc. After you have your expenses listed, put how much you will spend next to each one. Here is an example:

You’ll notice at the bottom there is an “excess” – that is extra money in the budget, not allocated to a specific area. If this is your first budget, congratulations! Before you do anything with that excess though, work with your budget for a few months, to be sure you didn’t make mistakes. If it is still there after the first 3 months, then you are in good shape. You can allocate it to a few things:

- Rework your budget to include any extras that were not included in your first budget. Great examples would be a vacation fund, clothing budget, etc.

- Savings – use the excess to save a small emergency fund, to break the cycle of debt. $1000 is a great place to start for that. Once you have your emergency fund set up, proceed to step 2.

- DEBT! Apply the excess as a PRINCIPAL payment to your smallest debt first.

- Savings – if you don’t have any debt, GREAT JOB!!!! Apply it to savings. Not an emergency fund, but excess savings. You’ll want to build a true emergency fund, which is 6 months of expenses.

Congratulations! You now have a basic working budget. This is the first step on your journey to financial freedom. Commit to your budget, and you’ll be set for success. But remember, this is just the first step. Gaining financial freedom takes hard work, and dedication.

Be sure to review the next post, on building your budget from scratch. Once you have your basic budget, you are ready for the next step.