Debt Payoff Plan – As Quickly As Possible

When you’re drowning in debt, it often feels like you can never get out. Minimum payments are a struggle, and you feel like you can never get ahead. Rest assured, if you work hard, and make sound financial decisions, you can break the cycle and get out of debt.

Today, we are going to share with you how to create your own debt payoff plan. Before you get started making your debt plan, make sure you have a working budget. Learn how to start a basic budget here. Create a working budget from start to finish here. Get your copy of our free budget planner to get started planning your budget. Still not sure? Check out 6 Reasons Why you need a budget before continuing.

Now that you’ve got a working budget, let’s create your debt payoff plan.

Payoff Debt – The Plan

Start by listing all of your debts in ascending order, not including your mortgage. Using your working budget, determine how much excess you have to apply towards debt payoff. This is based on already having an Emergency Fund saved. If you do not have at least $1000 saved in an emergency fund, back up. Apply the excess in your budget first towards your savings, in an emergency fund.

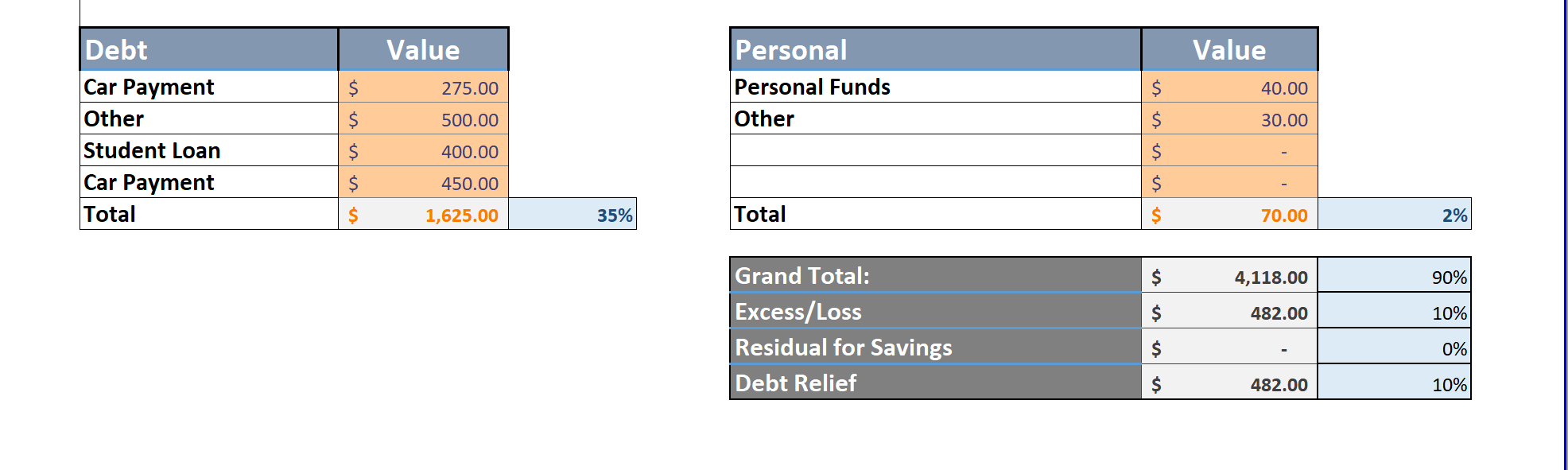

To understand what I mean, check out this snip from one of our budget spreadsheets.

**Disclosure: This is a fictitious example based on information from various financial scenarios we have encountered. This is not the financial information of any one person we have worked with.**

This person has $482 remaining at the end of every month.

Step 1 – Save an emergency fund

If they do not have an emergency fund, that $482 for the next 2.5 months should go directly into a savings account for an emergency fund. After they have their $1000 emergency fund set up, they can start their debt payoff plan for those 4 debts listed in the debt section.

Step 2 – The “Debt Snowball”

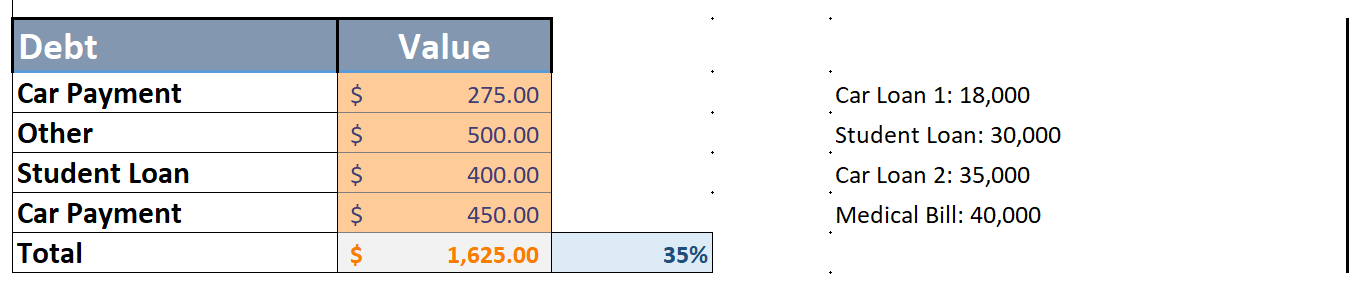

The excess $482 would go towards paying off those debts as quickly as possible. This method is what is often called the “debt snowball”. You’ll take those debts, listing them least to greatest. You will pay them off in that order, applying the payment from the last debt towards the payment of the next item.

Here is an example:

Debt 1 – Car Loan – $18,000 ~5 years early

Debt 1 – Car Loan – $18,000 ~5 years early

They have 4 total debts. After they’ve started their emergency fund, they will continue to make their minimum payments on all their other debts. In addition to that, their $482 residual income every month should then be applied to their first debt. In about 2 years, the first car will be paid off.

Debt 2 – Student Loan – $30,000 ~7.5 years early

After that, the total car payment, $482 + the original $275, so $757, should be applied towards additional principal on the second debt, the student loan. Remember, this $757 is in addition to the minimum payment of $400. With these extra payments, the student loan will be paid off in another 2.5 years.

In less than 5 years, this family would potentially be able to pay off $48,000 worth of debt, on less than $60,000 a year. This is excluding any additional bonuses, tax refunds, etc. Any excess payments received should be applied towards debt payoff, when you are working towards financial freedom.

Debt 3 – Car Loan $35,000 ~3 years early

So, at year 5, There are still 2 loans left. But, we now have $1,157 excess income to apply towards debt payoff. The 2nd car loan’s minimum payment still gets paid, with nearly $1200 towards principal every month. 2 years later, that car is paid off.

Debt 4 – Medical Loan $40,000

The last debt has $1,557 towards principal and will be paid off in 15 months.

The debt snowball works by applying the increasing money towards the debts as you continue to pay off your debts. This is assuming you pay them off as they are. Each family is unique, and each situation has their own circumstances.

This family still is completely debt free after 7.5 years, paying off over $123,000 of commercial debt, on an income of just $55,000, without making any changes. Depending on how desperately you want to get out of debt, you can change your circumstances in several ways. In the next post, we’ll discuss the different options there are to reduce your overall debt payoff time frame. We’ll give some simple strategies you can implement into your budget today, that can cut down your overall debt payoff timelines.