Financial Tools And Discounts Most Of Have But Never Think To Use

Buying a car can be either very stressful or very enjoyable. If you have planned for a long time, then you are likely looking forward to buying a new car. Unfortunately, if this is an immediate need due to a recent event, enjoyment is probably one of the farthest things from your mind. In either case, it is best to use ALL of the tools at your disposal.

Your Current Car Or Extra Car

When looking for a new vehicle, the first tool and asset to you is the current vehicle you own. This can either be your main car or an additional clunker. In either case, you will likely have some kind of equity in it. When the vehicle is paid off completely, meaning you have a free and clear title, you can use the residual value of the car to apply towards the purchase of a new one. If you are still paying for the car, you will need to check to see if you owe more than it’s worth or if you owe less. If you owe more, you will HAVE to make up the difference in cash either at the time of trade or through paying down the loan on the vehicle prior to the new purchase. Ideally, if you are in a situation where you are having to make up the difference of a loan or still owe money on a current car, you should not be buying a new car. In a previous post, I have mentioned I am looking to trade in my Audi for a new truck. To better help you understand these tools, I will be using some figures from my situation as a reference

Current Vehicle Book Value = $15,000

Loan Amount Owed = $0

Trade In/Selling Equity ~ $15,000 ( For those who don’t know “~” means Approximately)

Cash You Have Saved

The next best tool you can use is cash. This may seem like a given, but it is one often neglected or miss appropriately used. Using cash does not mean draining any fund you have with regards to your accounts. These cash funds should be explicit funds you have dedicated to the purchase of a vehicle for a significant amount of time. You should not be touching your emergency fund, debt payoff, or six months of expenses. If this means you only have an additional $1,000 to put towards your car, then this is all you have. Even the smallest amount of cash can make a difference. Again, ideally you should be able to pay for a new vehicle for ALL cash, but I understand life does not always work according to our plans.

Current Savings For A Truck = $8,000

Value Of Savings Needed = $15,000

Additional Savings Needed = $7,000

Check Your Connections And Other Company Discounts

Employers often provide discounts to their employees for products and services. In many instances, these are limited to smaller items such as cell phone, travel, food, etc. In other scenarios, you might have additional perks you were not aware of. For example, if you are a teacher, you may have educator discounts through certain car manufacturers. The same can be found if you are a recent college graduate. Another option is to check with your friends who might work for car manufacturers. Often these individuals can log in to their accounts and get a discount code to be provided to friends and family every 90 days. These discounts are another great bonus for decreasing the overall cost of the vehicle you are looking to purchase.

Current Discounts Known ~ $6,000

Negotiation Part 1

Negotiating the purchase of a vehicle can be tedious and can take practice. However, the payoff can be great. Negotiating down the price is one avenue you can take to get the best price of the vehicle you are trying to get. Often negotiations can take a long time. This is why you have to be willing to wait it out and stay strong. Do not be scammed with the “Let me go check with my manager” routine or the “Well, my manager said we can do $$$ less than what you suggested.” They are in it to make the most money out of the deal. Remember, you can ALWAYS walk away from the dealer if they are not meeting you in terms of negotiations. If you are uncertain in your abilities to negotiate down the price of a purchase, I would suggest finding someone who is and take them with you. In most case, they enjoy the haggling process, I know I do.

Negotiating Ability: Advanced

Estimated Negotiation Value Decrease = $ 2,000 (based on current truck research)

Negotiation Part 2

I will preface part two of negotiation as to be reserved for someone who has the ability to meet all demands. It requires the user to take a hit to their debt-free lifestyle in order to get a better price. If you are still struggling to get out of debt, please disregard this part and focus on the first four above. Part two would require you to take out a loan. Yes, it is a four-letter word, but let me explain. With most dealerships, you have the ability to finance through their lender. As such, there are often further discounts you are able to utilize through this. In this case, you would need to find out what the minimum value is in which you would need to finance to get the full discount on the purchase. These discounts can range from $1,000 – $3,000 on average. In most cases, the minimum value to be financed would be $5,000 in order to meet their lending requirements.

Minimum Loan Requirement = $10,000

Financing Discount = $1,000

Calculations For The Best Deal:

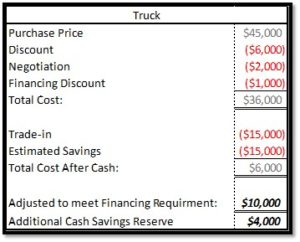

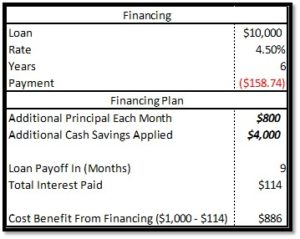

Based on the information provided, we can see how the current scenario might play out with a purchase price of $45,000. Unfortunately, there is too much cash saved and cannot all be applied to the initial purchase since I would not meet the $10,000 requirement for the financing discount. Thus, the excess is saved to be applied toward the loan afterward.

The cash combined with extra principle payments predetermined through my budget, the new loan would be paid off in about 9 months. During the life of the loan, I would have paid approximately $114 in interest. However, the discount received for the financing was $1,000. Thus, the net benefit from the financing is decreased to $886. Without getting into the discussion of the time value of money, saving $886 simply for financing is great!