New Year – New You! Top 4 Financial Resolutions for 2018

We do it every year, right? We set our resolutions. THIS is the year I’m going to get my life on track. This year I’m going to lose weight. THIS year I’m going to get a boyfriend. THIS year I’m going to get my finances under control. We set our New Year’s resolutions at the beginning of each year, but most of the time we end up breaking them. We set these big goals, but we don’t have the discipline to complete them. Maybe we even set our financial resolutions – pay off debt, save for retirement, spend less money… The list goes on.

This year can be the year you take control of your finances. But, it will take discipline. There will be sacrifices. If you want to live a life without debt, you will have to live without some of the luxuries you have had in the past. Are you in?

If you’re still reading this, that means you’re willing to make those drastic changes that coming with living a finance-free life. But what does that look like? What are the changes that need to be made?

Live on a budget!

Your first step to financial freedom is living on a budget. A basic budget is your income, minus your expenses. And you can’t say, “Oh I keep track of all my expenses. I know how much I spend every month and keep track of it in my head.” You may think you keep track of it in your head, but when you actually write down what you are spending, you’d be surprised. So, write down your budget and keep track of all your expenses. Even better, check out our free budget planner. It’s a spreadsheet with a built-in calculator to help you get started budgeting today! The most important thing to remember about a budget is to stick with it! A budget won’t work if you aren’t using it! Even if it’s negative, there’s not enough money to pay all the collectors, you have to start somewhere. Pay the necessities first, then work your way down the list.

Limit your spending.

Your budget won’t work if you don’t have a way to limit yourself. Whether it’s cash envelopes, debit cards with automatic transfers, or some other system, figure out a way to limit your spending within your budget. If you don’t have this sort of system in place, it’s guaranteed that you will overspend. Look at your history. What’s happened every single time? Cash envelopes are a great place to start, for many reasons. First, you physically see the money you’re spending – it’s harder to part with cash than it is to swipe a card. Secondly, it’s harder to excuse overspending cash than it is with a card. To overspend cash envelopes you either have to a) take from another envelope, which is designated for another purpose like rent, utilities, clothes, food, etc, which you’ll be unable to pay later… Not a good idea. Or, b) swipe a card, which may or may not have enough money in it.

Stash an emergency fund.

The best way to break the cycle of financial insecurity is to establish an emergency fund. Ideally, an emergency fund should have 3-6 months worth of expenses in it. This may not be a realistic step for you at this point. That’s fine! What is realistic, however, is a small emergency fund. We recommend an emergency fund of at least $1000 in savings. This is for true emergencies, like a flat tire in your car, a/c in your house, etc. This helps break the cycle of overspending on credit and spending beyond your monthly income. If you are financially able, you should save 3-6 months of expenses. This can be calculated by looking at your budget. Six months of expenses would be your overall bills, including housing, utilities, insurance, debt payments, etc. to ensure that in the event of a financial emergency, your family would be able to pay their bills.

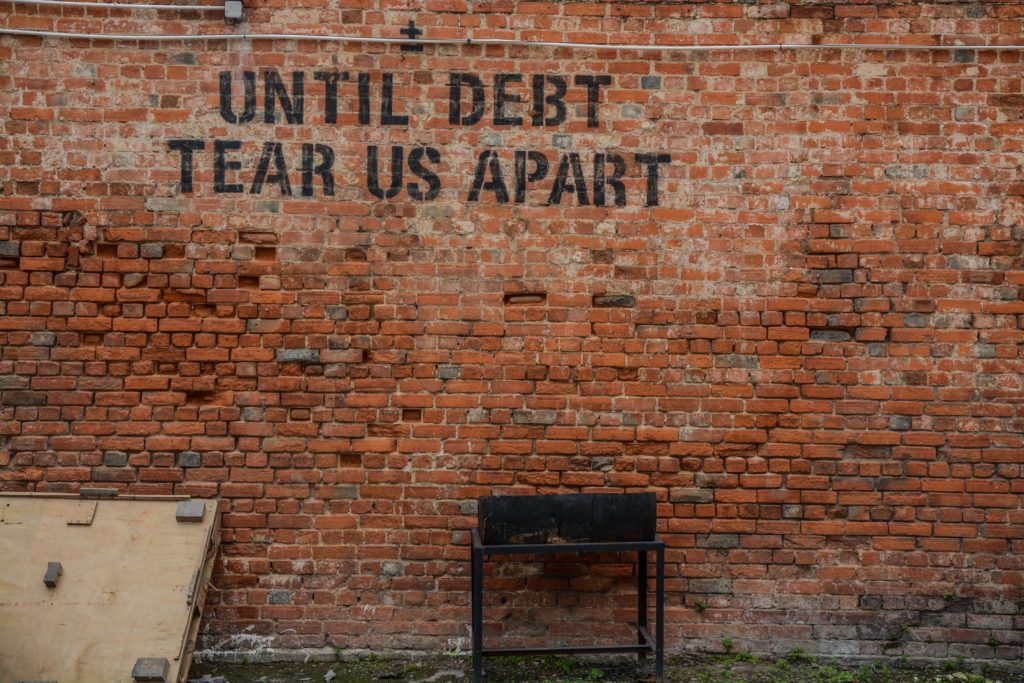

Pay off debt!

Pay off debt!

Pick your top 3 smallest debts, and start paying them off! After you’ve created your budget and your emergency fund, use any excess money in your budget and pay off your debt. Debt in your life can be a HUGE financial burden. Take it from me – when we started this journey, we had close to $71,000 in consumer debt, between student loans, car loans, credit card debt, etc… It is a heavy weight to bear. But, if you start small, one step at a time, you can work your way towards being financially free and never look back.