Spenders vs. Savers: Part 2 Savers

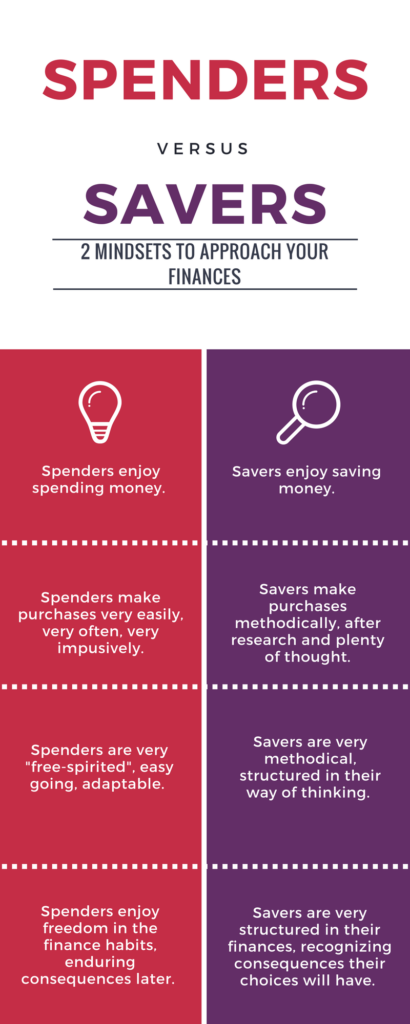

This is going to be part two in the spenders versus savers discussion. In our last post, we got to see the viewpoint of a spender. There are probably many things within the post which many of you could relate to. In many cases, having the thoughts of being tied down and limited in the money you could spend was torturous. After all, it is your money, shouldn’t you have the option to spend it if you want to? Why would you want to delay feeling those wonderful feelings, not to mention have something brand new to show for it? For spenders, these thoughts are simply understood. There is nothing inherently damaging by these tendencies. To a saver though, these thoughts and tendencies seem like blasphemy.

The Life of a Saver

I have not always been a saver by nature. In fact, when I was little I distinctly remember my mother mentioning to someone else I was going to be the one who would spend money when I got older, and my brother was going to be the one who saves money. As with most impressionable children, this stuck with me. Granted this wasn’t the only thing that made me into the person I am today. The biggest cause of my saving mentality stems from the Financial Crisis of 2008. I was a teenager, who knew he was going to have to pay for college because many of the scholarships and financial aid at the time was being removed. Thus, I started saving.

Fast forward about a decade, and many more things have changed over the years. I have not lost my Saver’s Mentality, but it has gotten easier to spend. For many years, it was second nature to save nearly all the money I was making working as a personal banker and only spend my money on the essentials. Everything else was saved in a saving account or my current checking. I would watch my girlfriend at the time (wife now) spend money like it was going out of style. It gave me so much trepidation in combining finances someday when we got married. I had already witnessed hundreds of other customers struggle with their joint finances because one of them was the spender and one was the saver. There was never a winner. It was a losing battle. It didn’t have to be a battle though?

I was under the false assumption spender just lacked the proper tools to be able to manage their money. Once they understood where all the money was going, they would most certainly see it from a savers point of view and change, after all, I was right! Well, as you can imagine, using this forceful mindset didn’t work. Rather, it brought more contention into the relationship. To another saver, the amazing, detailed budget would have been met with praise. However, to a spender, it was met with rebuttal and defense as they are trying to defend why they are purchasing certain items.

In my mind, there wasn’t a problem with wanting to save money. There was a problem when I was using barely any money at all though. Having a Saver’s Mindset proved to be a detriment in many ways, even though I thought it was the best. With the desire to save as much as possible limits your ability to enjoy life. There is also an added stress for every time there is a swipe of the card or an exchange of cash. From this, also stems the added worry of money, even over the stupidest things. It wasn’t going to work this way now, and it wasn’t going to work when we got married.

Through many, many, many talks with my wife about our finances, I found it wasn’t a matter of forcing something on her and I. Instead it was the need to ensure she was educated on our finances and where all of the money was going. The same is true for me though. I needed to learn to relinquish certain constraints on the budget and actually plan to be wasteful. I do not mean throw moneyaway. Instead, we needed to allocate a small amount of money to simply waste of nonsense stuff. This gives my wife the ability to enjoy spending money on her wants, and it teaches me to relax while spending money.

Saving and spending do not have to be torturous affairs for either person. The best actions are communication. Sit down with your budget, spouse, and maybe a bottle of wine. Talk things out, be open-minded, and know this is a good thing for everyone. It won’t change the way you each feel overnight, but in time, it will be one of the best things you all can do for yourselves and your future.