The Easiest Way To Pay Off Your Student Loans Faster

Student loans have become an unfortunate necessity of our lives today. Gone are the days of being able to obtain an affordable secondary education. With rising tuition, transit, living, and other fees, the college experience has become a huge burden on most families. Parents who had student loan debt are on average still paying off their student loan debt when their kids are about to go to college. Thus, not allowing the parents to help their kids with these enormous costs. This becomes a vicious cycle through multiple generations until there is a break in the pattern. My word of advice – STOP THE CYCLE NOW!

Where to begin:

First things first, you need to start with your budget. Sure, there are other ways to be proactive before you start accruing the debt, and other avenues to pursue to get financing for your education if you are lucky enough to be in that position. Unfortunately, this is not where most of us are at. We need help dealing with our student loans that we already have. If you want tips on how to stay out of debt while getting your degree, skip ahead to the end of this post. As I said, your first step should be having a working budget. If you don’t have one yet, please check out our budgeting posts and complete your working budget first. Don’t forget our free budgeting tool. Get yours here.

The tools you can use:

Your budget will show how much total debt you have and how much you are paying on a monthly basis. Focus in on the student loan debt – break them down a little more. First, find out if they are PRIVATE or FEDERAL student loans. The type of loan will impact how you approach it. We will start with Federal Loans. There are 3 options for repaying Federal loans.

- Refinance. There are several servicers, such as FEDLOAN SERVICING at https://www.myfedloan.org/ that offer refinance options. This system will allow you to see all of the federal loans you own and will also allow you to consolidate your loans for a longer term with a smaller payment. There are obviously many different lenders or servicers you can go through, but this seemed to be the easiest of all the sites for federal debt.

- Payment Plans. If you do not have the option of refinancing your loans due to extenuating circumstances (e.g. credit, income, other debt, etc.), you can get help from the government. They are not going to bail you out, but like most lenders, they are willing to work with you to get their payment back. Check out https://studentaid.ed.gov/sa/repay-loans. There are multiple links and articles to figure out payments. They can give you income-based repayment, payment deferrals, and modified payment plans to work with you. Yes, in some circumstances you MIGHT qualify for forgiveness; you will have to submit paperwork for that and complete a service-based repayment. And, most of those require a minimum of 10 years of consistent payments before forgiveness is an option. You can pay it off much sooner than that. Which brings us to…

- Payoff with a budget. Now, for those of us who can’t do either of those options – but still have the ability to pay the loan payments – this is where your budget is key. With your debts listed, you know how much money is going to savings, and how much is being set aside for debt payoff. Start taking the debt payoff money and applying it to the principal balance of the smallest loan balance first. Work your way through your debts, focusing on the smallest loans first.

It would be wise to incorporate more than one of these suggestions to completely demolish your student loan debt.

Next on the agenda is Private Loans. These are a little different because many of the loan services do not deal with private loans. This makes it a little more difficult to find relief. Unlike Fedloan Servicing, there is no one site that provides all the information you need. The main source of help for these loans will be through some form of a lender. One site comes close, https://studentloanhero.com/, offering consolidation services with plenty of other features to allow easy understanding and visibility. I consolidated my loans through SoFi, https://www.sofi.com/. It was a very easy process to submit and get approved. Customer service was very responsive and helpful, and online banking is easy to navigate. Again, these are not the only options. There are many lender options, but these are the most popular. The last option, as with federal loans, is to use your budget to make the payoff more effective.

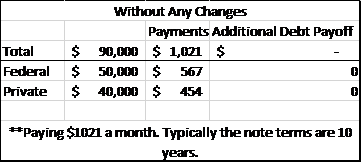

Check out these 3 examples of how you can pay off your debt quicker. Without doing any kind of adjustment, your debt will continue to create issues.

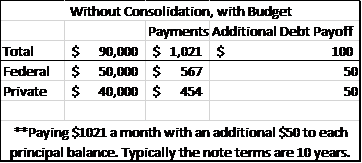

Even with a budget adjustment, your debt is still a long way from being paid off.

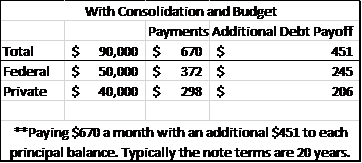

If you are able to incorporate both adjustments to your finances, you enable yourself to apply almost a whole payment to the principal of each loan. You could also apply a large principal to one loan at a time.

Use your head. Take the step that makes the most sense in your current financial situation, and work HARD to pay off that loan as quickly as possible. Until next time…

PLEASE NOTE: DO NOT DEFAULT ON YOUR STUDENT LOANS. YOU CANNOT ELIMINATE THEM WITH BANKRUPTCY. THESE ARE EXEMPT ITEMS, YOU ARE BETTER OFF PAYING THEM.