This Simple Trick Will Save Thousands Off Of Your Mortgage

Owning a home is an amazing feeling. Having a place to call your own is great, except for the mortgage. Mortgages are necessary debt most of us have to abide by if we wish to purchase a home. However, the mortgage prices today seem to be skyrocketing. This combined with the recent change to increase in the interest rates, owners need a way to counteract the negative effects. Luckily there is this simple trick which is not new, just under utilized.

The Basics

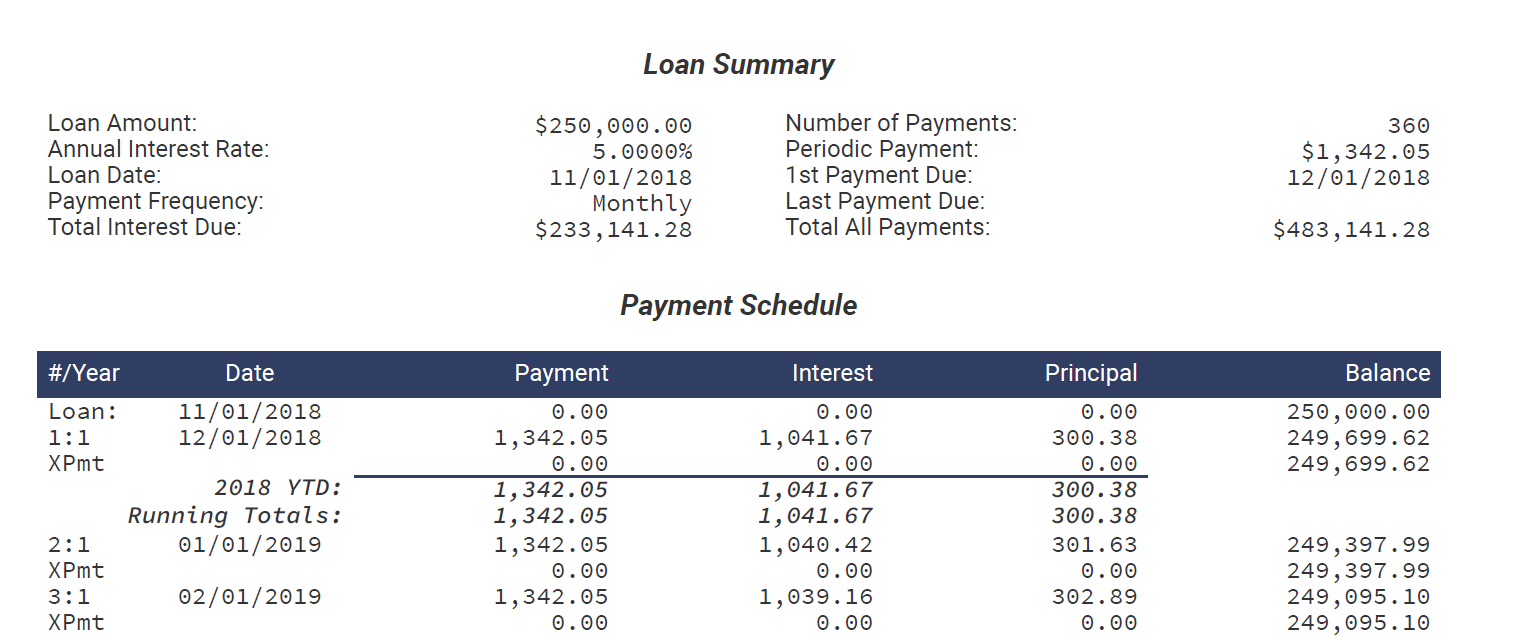

For those who may or may not understand a mortgage and how it works, I will give you a high-level understanding. A mortgage is just another type of loan which uses your home as the collateral source. The total payment is calculated at the beginning of the loan depending on your interest rate, total loan, type, and years. For clarity, we will use a $250,000 conventional mortgage at 5% for 30 years. There are other forms of mortgages out there, but we will not be discussing them here as to avoid confusion.

The Amortization

Amortization is the process of breaking out the cost of a loan or other payment. In the case of a mortgage, you would see your payment broken out in principal payments, interest payments, and the total. With most mortgages, you are paying more interest up front. This is due to the high value it is calculated off of. As you gradually pay towards your principal, the interest is also decreased.

The Extra

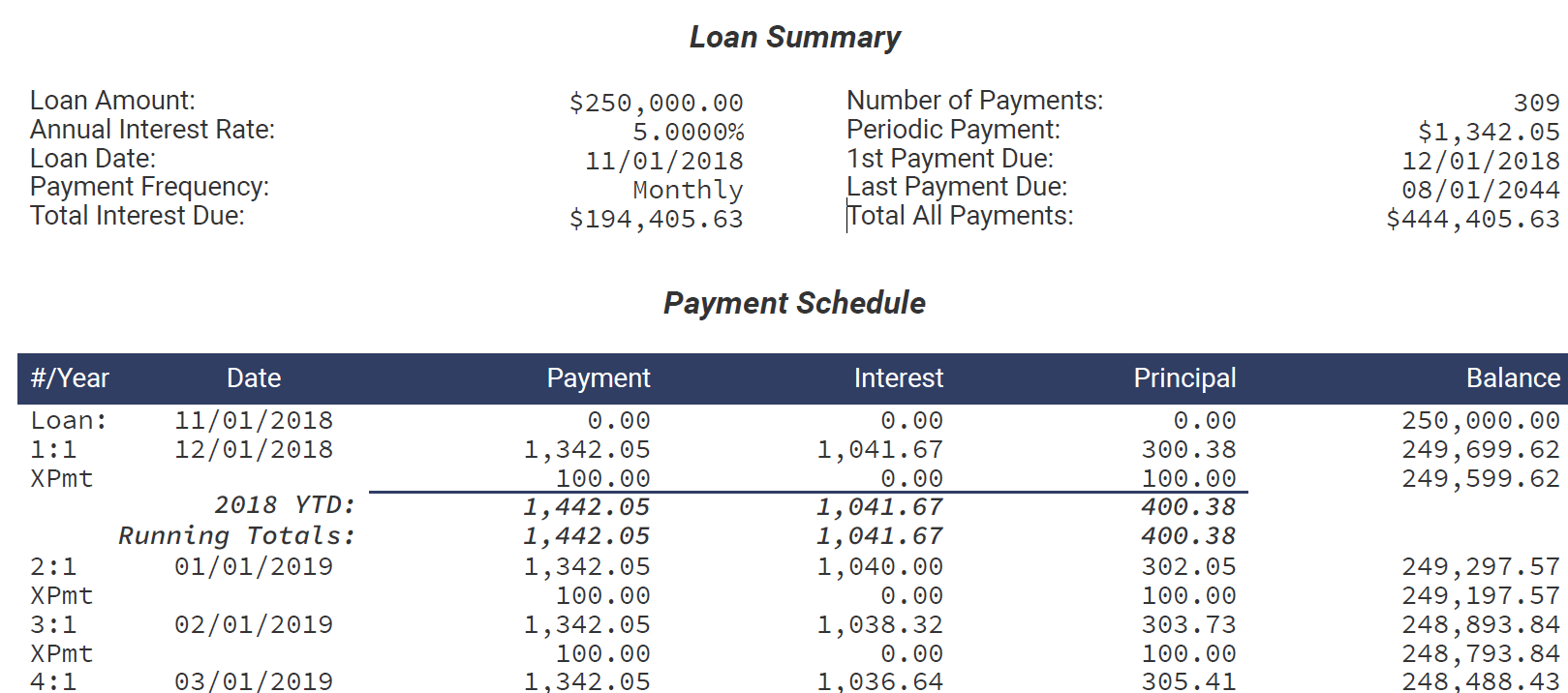

Once the loan is established, you will have a fixed payment every month of principal and interest. However, is you have planned accordingly, you can easily afford this payment. The simply trick many choose to ignore or are otherwise unable to do is to pay more toward principal. Yes, you can either call your mortgage company or go online to apply more money toward your principal. In doing this, your interest with drop faster and your mortgage will be paid in full that much sooner. Look at what an extra $100 a month towards principal will do? If you compare the total interest payments at the top of the original above and the updated below, you would have saved about $39,000 in interest!

The Lost Money

This is such a simple trick to save thousands of dollars on your mortgage. If the example was just $100, imagine what it would be with $300,$400, $500, or $1000! You would be saving hundreds of thousands of dollars on your mortgage. So, then why do so many not use this simply method? The truth is, many can barely afford their current mortgage as it is with all of their other expenses and debt. A mortgage is a necessary evil if you want to own a home. However, you can be smart about it and plan it out as best as possible. It all starts with a solid budget. If your budget is lacking, your finances will follow in it’s path. If you are struggling to get your budget in order, check out this article to help.