Time Value Of Money And What It Means For You

Financial literacy is something we all can benefit from in our everyday lives. Understanding how to create and manage a budget is an example of the most basic forms of financial literacy. However, there are so many other topics and discussions which most will likely never know about or learn. One of these topics is the Time Value Of Money. It is a basic concept to understand but will have huge impacts on how you view the money you make and the money you could be making.

The Basics

Time value of money is one of the first things you are taught when pursuing a finance degree. It is referred to as TVM for short and is the relation between how money becomes worth less over time. Essentially, if you were to hold one dollar in your pocket for a whole year, it would have lost a percentage of its buying power over the course of the year. This would be primarily due to inflation and the rise in the price of goods. The concept itself is much easier to understand that the actual calculations to get to the desired outcome. Calculating the TVM for a given scenario requires such things as an interest rate, future value, present value, number of compounding periods, and the total number of years. With all of this information, a reasonable calculation can be derived for the total time value of money. Having these variables allows the user to calculate the values needed for the analysis. See further information support here.

Real World Applications – Background

The time value of money is an integral part of corporate finance. When making large-scale financial decisions for companies, the TVM is one of many other reference points used. One of the common applications for which TVM is used for is in evaluating investment decisions. Since most companies are in the business of making money, they attempt to maximize the growth and minimize the potential loss through time. Thus, they incorporate investments into their revenue models. The estimated variables will be readily available for most investments and can be used to create predictive models for each investment. From these models, a company is able to make business decisions on which to choose from. Although most of what they use are estimates and assumptions, they are still able to come to a certain level of comfort in their decisions. This same methodology can be used on the personal side as well.

Personal Finance Application

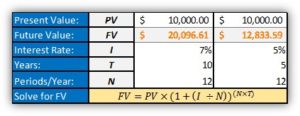

Understanding the concept of the time value of money is the main point of this post to allow you to have another frame of reference for your personal finances. The time value of money as it relates to personal finance can help you plan your future financial circumstances if you choose to calculate yourself. At the very least, you will be able to better understand how an advisor or online calculators will estimate the future value of your money. For example, you have $10,000 you are going to put in an investment. However, you have two options to choose from. One of your options is a 7% for 10 years and is compounded monthly. The other option is 5% for 5 Years and is compounded monthly. Each of the investments is locked in and cannot be withdrawn during the life of the investment. Both seem like viable options, but without knowing the outcome, the higher interest rate seems like a better option.

Both Calculations:

Review Your Options

Both options will provide you more money over time than you would have made without investing. In the first option, you are receiving more income than the alternative. The higher interest is also more appealing to an inexperienced investor. However, these factors are not always going to be the best items to review. Although the first option is making approximately $7,500 more over the life of the investment, it is also taking an additional five years to complete it. With the second option, you have the ability to make nearly $3,000 in five years. You can then reinvest the $12,833 at a different interest and term based on the options in the future. Obviously, there is a risk in doing either one of these options. There are risks such as interest rate change, extended time of having money locked up, etc. Potentially having your funds invested for a shorter period of time will provide more flexibility in managing your financial growth, and can be more profitable. Ultimately, it will depend on how you want to proceed with your investment structure. Knowing how to value your options appropriately will further provide insight into making the best decisions.