Understanding Your Paycheck

Have you ever really looked at your paycheck? What does all of this gibberish mean? And WHY is my gross pay so much lower than my net pay? Why do they take out all of this money for taxes? Well, here we will uncover what all of the information on your paycheck really means, so you can understand where your money is coming from, and where it is going.

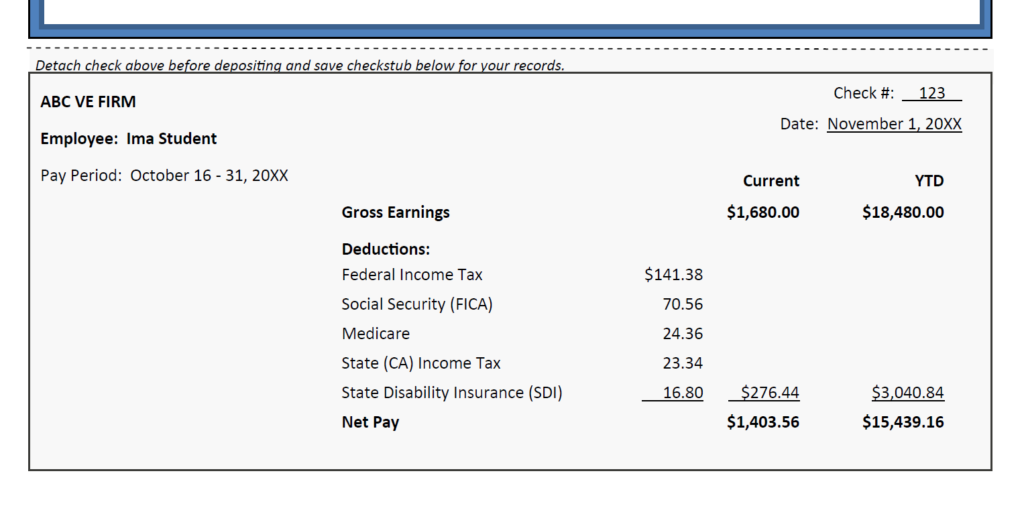

You probably have a paycheck that looks something like this:

But what do all of these things mean? These are all deductions from your paycheck, taken out typically as a percentage of your Gross (pre-tax) income. Some of you may even have more deduction categories on your check, like Retirement, Insurance – vision, medical and dental, and maybe even association dues. Regardless of what categories you have, the basic understanding you need to have is that these are deductions from your paycheck, that are pre-tax percentages of your income.

Let’s break it down a little bit further. The first thing you need to understand is your pay period. This part is relatively simple – it is just the time period in which your employer is paying you for working. If you are salaried, this should be the period immediately before your paycheck. IE: Period ends on October 31st, pay is November 1st. If you are hourly, however, this pay period will typically be about 2 weeks behind. This is due to the time required for your companies to submit payroll appropriately after you have submitted your time cards. This isn’t the case with all hourly employees, but most of them.

The next section to look at is your GROSS EARNINGS. This part of your paycheck shows you two things about your income. The first, in the red box, shows your current gross pay. That means that for this pay period, you earned $1,680. This number is what you would use for your credit applications when they ask for your gross income. In the blue circle, it shows your gross income for the entire year, up to this point. This is not a projected earning, but rather what you have earned since January 1st.

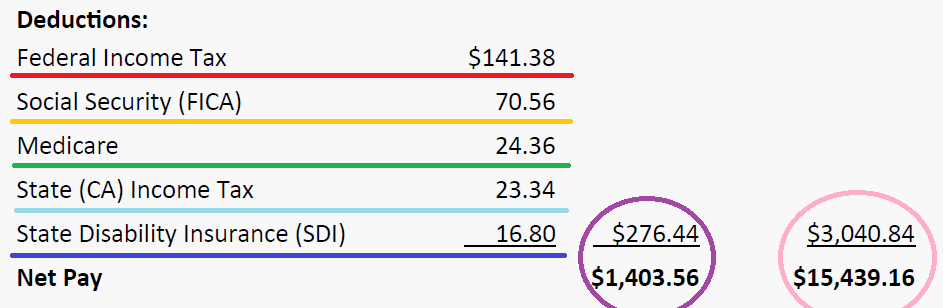

The last section of the paycheck that you need to understand is your deductions. Your deductions are the items being taken out of your paycheck, broken down by item.

The first item is in red, the federal income tax. Your federal income tax rate depends on your overall income. That determines which tax bracket you fall under. There are a lot of different factors that play into your tax rate. For the purposes of this sample, let’s say this person pays 8.5% tax rate (lower than the current rate, but for these purposes, it will work. $1680*8.5 is approximately $142.80. That is your first deduction.

The next deduction, shown in yellow, is the social security deduction. This is what pays for current social security benefits for retired adults. The program was not designed this way – it was originally designated as a trust fund, with deductions being paid into for a future withdrawal. Over the course of our government, this has changed. They now use the current social security payments (from your paycheck) to pay for the current social security benefits. This is why you may hear many people say that social security will not be an option when they reach retirement age.

The third deduction is Medicare (green). Again, this is a percentage of your income taken to cover current Medicare benefits. The concept behind this process is that when you retire, you will be receiving the same benefits. So you pay into the program now in order to receive a future benefit. We’ll see how that system works out in the years to come…

The 4th line (light blue) is a deduction for state income tax. This varies from state to state – some states have a higher tax rate, some have lower. Again, this is a percentage of your paycheck deducted to pay taxes based on your income bracket.

The last deduction (dark blue) is paying for disability coverage. If for whatever reason, you were to become disabled and unable to work, you could apply for disability insurance. When you hear people talk about living on disability payments, this is where those payments come from. Every state is different, but the concept is the same.

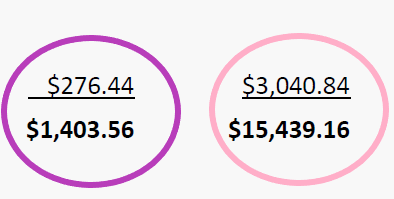

The last section is your net pay. This shows what your paycheck and income is after all your deductions have been taken out. On this section of your paycheck, you can really the difference between what you earned, and what your takehome pay is. If you pay for insurance for yourself or your family, I imagine there is a very large difference between those two numbers. The purple circle is the breakdown of deductions and take home pay for the pay period, and the pink circle is the breakdown of year-to-date deductions and takehome pay.

Hopefully after all of this, you have a better understanding of your paycheck, why things are broken down the way that they are. As always, we’d love to see your reactions to this post, so be sure to leave a comment below!

Until next time!