Wealth Extraction – Consumer Traps to Watch Out For and Save Money Part 1

In this day, companies are constantly advertising to you, trying to make money from you. However, if you’re smart with your money, you can learn to watch out for these consumer traps, or as we like to call them, wealth extraction. Anything that a company sells or markets to you, that is really just a way to make money and not a needed product, but something they can convince you to buy would be considered wealth extraction. If you can learn to watch out for these traps, you will start to save a significant amount of cash on your trips to the store. Remember, these companies have done a TON of research into psychological links between spending and marketing. They know just how to trigger your brain to get you to spend money. Learn how to spot these traps, and how to avoid them.

1. Rewards Programs

These are the biggest way companies make money from you – rewards programs. From credit cards, to store loyalty points, to fuel rewards, the list goes on. This is a mega consumer trap! Rewards points trick your brain into thinking that you are actually saving money by spending more at this particular store because you are earning the money back later through another avenue. In reality, you are spending more than you need to. Instead, focus on your budget. Make a meal plan, and only buy what food you need from the store. Don’t spend extra to earn points, because it really isn’t worth it.

2. Instant Rebate

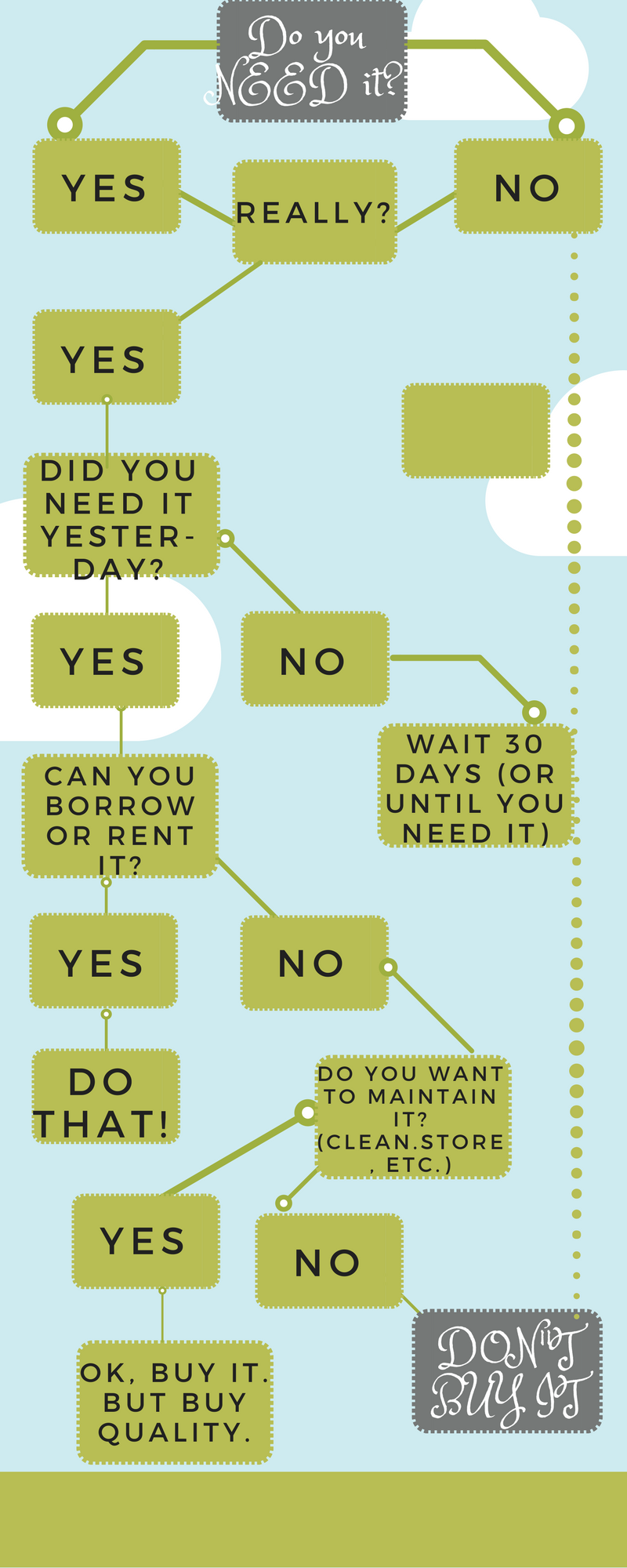

This consumer trap is really just a way to make you feel like you are getting a good deal on something you don’t actually need. With instant rebates like $20 on a Ninja blender, or instant $5 Target gift card when you buy 3 name-brand beauty products. These are all tricking your mind into thinking you are getting a good deal! In reality, you are spending more money, purchasing extra products you did not actually need, because of the money-back offer they were promoting. Don’t fall for it! Stick to your budget, and remember to ask yourself, “Do I really need this item?” Check out this graphic again: –>

If it doesn’t answer yes, then don’t buy it!

3. Scarcity Mindset

The scarcity mindset is where the retailers will try to make you believe this is a “limited time only” offer, or “limited quantity available”. Other types of these offers would be, doorbusters only through certain hours of the day, first 100 customers receive bonus coupons, etc. Scarcity has a unique effect on our brains and makes us do crazy things. When we believe that the likelihood of us not being able to obtain an item is low, it forces us to think that item is a priority. It is why little kids often fight over their toys. To combat this, remember your priorities – what is most important to you? Do you need to be first in line at the department store sale, or can you better utilize that money elsewhere in your budget?

4. Instant Markdowns

It is guaranteed that you have seen this strategy before – instant markdowns are where your price is instantly lowered because it’s on sale. It is similar to the Instant Rebate in #2, but you don’t have to deal with the gift card, mail-in rebate, etc. This is actually an extremely discounted price. Often times, this will convince you to buy something you don’t really need because it is at a low price. People do this all the time, at grocery stores and department stores. They will buy large quantities of discounted meat, produce, etc. and plan to freeze it and use later, but end up throwing it away. Don’t fall into this trap, just because of the price. Remember to think about these questions: Do you need it? Really? Did you need it yesterday? If the answer is no, then don’t buy it. Your brain is being hacked by the marketing traps.

5. Decoy Pricing

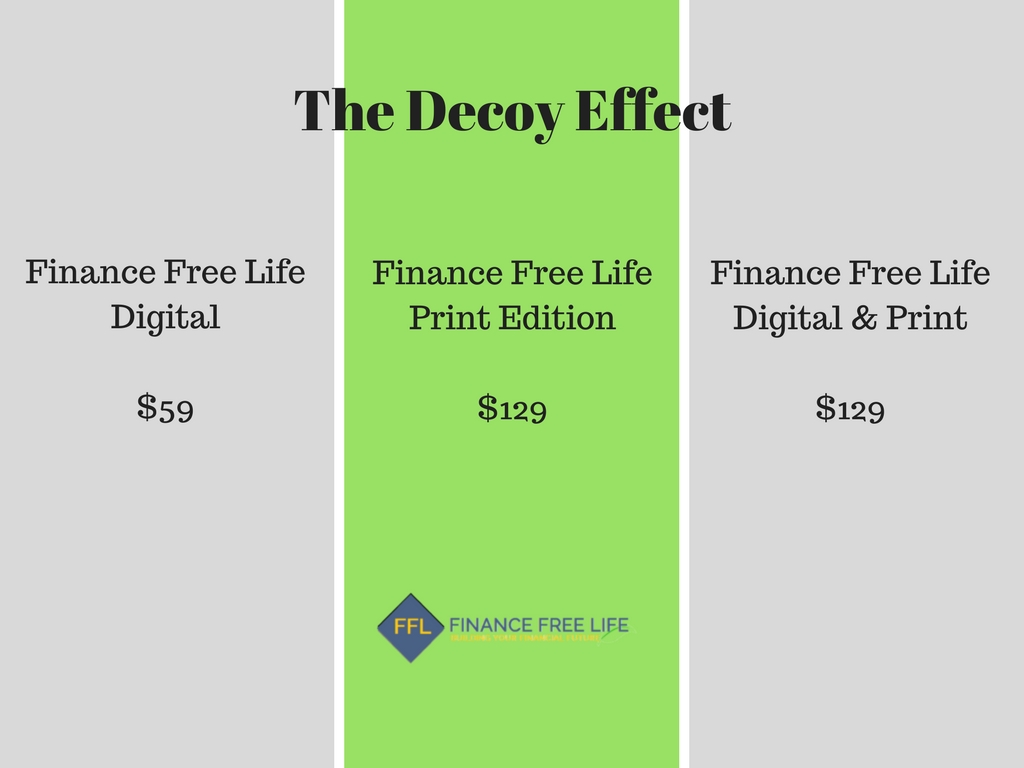

Decoy pricing is a really interesting strategy that you have probably not heard of but definitely have been a victim of in your expenditures. Basically, companies will use decoy pricing to force sales of a particular product or service. In other words, they strategically price a decoy item – an unattractive item they have little intention of selling – at an unequal valued price, to force you towards a more profitable purchase for their sales. Here is an example: Subscribe to Finance Free Life’s Digital is $59 a month. To Subscribe to our Digital & Print Edition, it is $125 a month. There’s a huge price gap between the 2, right? But with a small change, add in a decoy price: the digital and print edition now seems like a better deal, because you get both for the same price as the print version. This is decoy pricing, in action. Companies do this all the time, with much smaller things – t-shirts, business cards, meals at restaurants, etc. Now you know to watch for it! The key to remember here is don’t buy what you don’t need!

6. Loss Leaders

Here, companies will have HUGE markdowns on big selling items, to get you into the door of their store. Something they know they are going to take a loss on when they sell it – but, by doing so, they get you through the doors of their stores, and they know you will walk out purchasing more than that big-ticket item. For instance, 60″ flat screen TVs on sale on Black Friday, marked down to $200. That’s a STEAL. That’s enough for you to get out of bed at 2 am to walk through their doors – and that department store knows they have 20 other tricks up their sleeve to get you to spend money in their store, and they will make up the 50% loss on that tv through the piles of stuff you bought on that same trip.

7. Free Samples

Free samples are a big selling point for department stores and other stores. How many times have you gone to a bulk store (Costco, Sams Club…) on a Saturday morning, list in hand, and tried the samples. What happens? You come home spending 3x more than you thought, with 10 extra items that you tried a sample of, and liked, so decided to bring a box home. Stores do this on purpose so they can hijack your brain, and your stomach, into buying something you don’t actually need. Yes, those microwave taquitos and ice cream sandwiches may be delicious, but think back to those questions – do I really need it? Did I need it yesterday? Enjoy the samples, but don’t let yourself be tricked into buying something you don’t need because someone asked you to eat something tasty. They can hear the word no.

8. Store Layout

This one is my absolute favorite – grocery store designers were very intentional in their layouts. When you need 2 or 3 things from the store – bread, milk, and eggs, for instance – notice you will have to walk all the way across to the other side of the store to get those 3 items? Designers did that on purpose. What happens is you will walk past an advertisement, a snack, a drink, etc. and think of something that you may need or want, and buy more than what you came for. Think about all of the grocery stores you walk into, picture the entrances. What do you see? Typically, you walk into the floral section and produce, brightly lit and decorated, smells lovely to make you feel happy. Or, on the opposite side of the store, you walk into the bakery and deli section, where you smell fresh baked goods and food from the deli. Both of those are not an accident – designed to activate your senses, and trigger your emotions, and wallet, into spending more money. Combat it by making a few small changes: never shop while you are hungry. Always shop with a list. And always remember to think of wealth extraction while you are shopping – watch for how the store is trying to trick you.

Now you know how the big stores are trying to trick you, by making money off of your basic psychological instincts. The first step is acknowledging that stores do this, and being aware of their tricks. Once you are aware of how they are trying to trick you, begin to watch for signs of wealth extraction in your daily life. Advertisements, grocery shopping, even commercials will try to trigger your emotions and your basic instincts. Understanding how they work and remembering to ask yourself questions about your desire to purchase something will help you combat most of the frivolous purchasing stemming from the ads. Now that you’re armed with the tools to understanding, you’re on the path to saving money.

*Remember, the first place to start if you want to save money is to look at your monthly budget. If you don’t have one yet, start here.*