Revamp Your Budget

As a child, you are taught many things. One of which is the importance of saving your money. The phrase was even coined, “A Penny Saved, is a Penny Earned.” However, it seems most of us don’t learn much more past this common idea of saving money. Growing up, there was never a class to delve into the fundamentals of managing money. Fortunately enough I was forced to learn these skills when it came time to figure out a way to pay for my college on my own. During that time, I was working for a retail bank. Watching some of my clients manage their money played an intricate role in helping me understand what NOT to do.

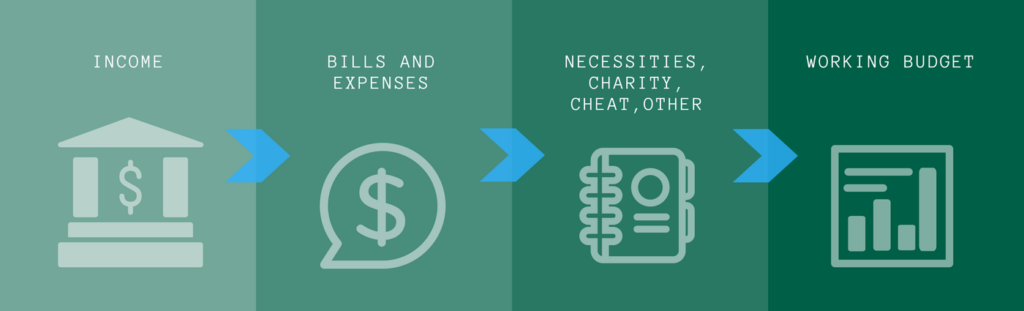

Fast forward to today, and I can look back on my mistakes: pitfalls I could have avoided, things I wish I had known then. I had financial struggles, as we all do, and there were also times when it seemed as if all was running very smoothly. Although there were many extenuating circumstances, the root cause of my problems resonated from my lack of preparedness – not having a sturdy, working budget.

Most of us have heard the notion of making a budget, and sticking to it, right? If you have read through other posts, you should already have a working budget. If you haven’t then stop here, and check out Create a Budget that WORKS! Unfortunately, there are many others out there who do not have a budget and they are struggling day after day. A recent study shows that 56% of millennials are living paycheck to paycheck. Why? Especially when their income, when properly managed, is MORE than enough to cover the needed expenses. I think the biggest culprit is their budget – it’s weak, or even non-existent! If you think your budget is as good as it gets, but you are still having trouble with money, might I suggest you revisit it?

Some key characteristics of a great budget will have the following items:

- Listing all of your bills by name with an approximate dollar amount (exact if you have it)

- Listing all of your necessities by name and amount; this includes gas, groceries, etc.

- Listing all of the contingency items, items you won’t buy every month (i.e. $20/Month for automotive)

- Listing healthcare items (i.e. Medical and Dental Visits, Prescriptions, etc.)

- Listing money to cheat with (i.e. restaurants, movies, treats, etc.) – THIS IS A MUST

- Listing of all charitable donations

- Listing of set amount for savings

- Listing of set amount extra for debt payoff

Keep in mind you may not have amounts for each of these categories, and that is okay. You may have other items that aren’t listed here. Just add them in.

Remember, many of the values you enter are going to change on a monthly basis. This is why it is a good rule of thumb to label your budget as a “Working Budget.” Do not let yourself get discouraged when it does not work correctly every month. My wife and I have a minimum of monthly budget meetings, to ensure we are still on track. It will take time a learning how your finances work, to better grasp your situation. I can promise you this will help grow your money management skills!

Until Next Time!……

Be sure to check out the post on actually building your budget from scratch….